%20(2).jpg)

Executive Summary:

Responsible investment practices are becoming ever more important to investors.

Environmental, social and governance considerations can have an impact on a company’s long-term viability, risk mitigation and performance.

Active engagement with potential borrowers on ESG risks forms a core part of Kimura’s process.

In 2019 environmental activism has created news headlines to put climate change and sustainable business practices centre stage. We have seen highly publicised and impactful protests by Extinction Rebellion in the UK, while on a global level, Generation Z is creating awareness through actions spearheaded by people such as Greta Thunberg. These groups are committed to raising the profile of climate change and are demanding positive action to secure the future of the planet. Social media and the digitised world have made individuals far more aware of the impact people and companies have had on our planet through years of implementing irresponsible business strategies. With mindsets changing, the next generation of investors are seeking ways to generate returns that incorporate considerations to preserve the planet and responsible decision making as standard.

The world of finance is now also starting to listen. In the aftermath of the 2008 financial crisis, financiers grappled with the immediate threat of

banking failures and responsible investment was a secondary concern for central bankers. Now that a heightened regulatory framework is in place, the threat from unsustainable business practices and climate change is increasingly seen as the next big unmeasurable issue. Key figures are echoing this sentiment and the requirement for companies to change; Mark Carney and François Villeroy de Galhau, respective governors of the Bank of England and France’s central bank, recently said in an open letter: “If some companies and

industries fail to adjust to this new world, they will fail to exist.”

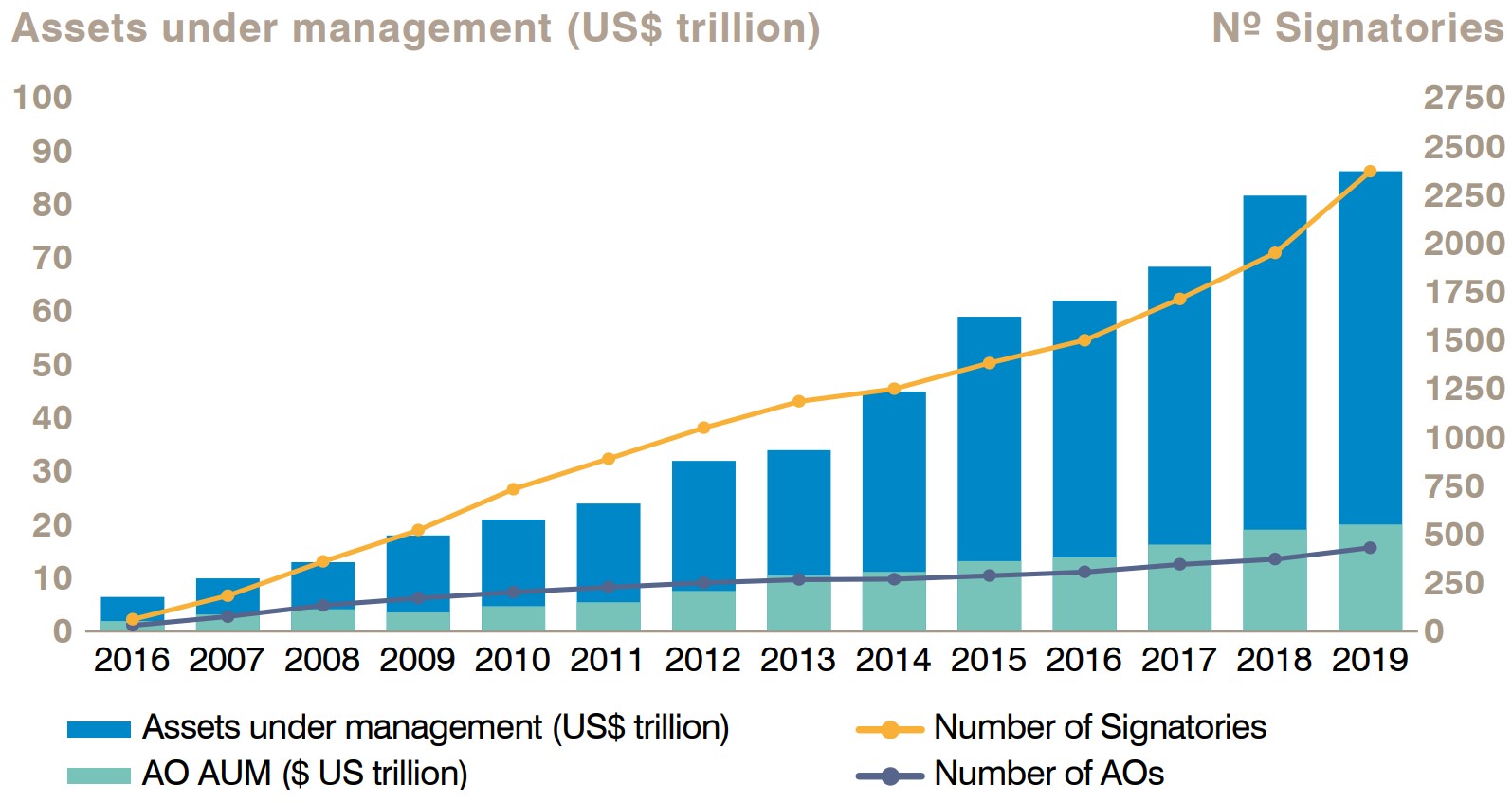

ESG used to be something of a niche concept, but ESG investment practices are now much more at the forefront of people’s minds. We are seeing more and more managers having an ‘ESG angle’ to their funds or operations (see Chart 1 below) with USD 89 trillion AUM (as at 30 April

2019) managed by groups which are signatories to the Principles for Responsible Investment (PRI). Larry Fink, CEO of BlackRock, said in a recent letter to corporate CEOs globally: “Society is demanding that companies, both public and private, serve a social purpose. To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society. Companies must benefit all their stakeholders, including shareholders, employees, customers, and the communities in which they operate.”

Chart 1: The rise of responsible investment – growth in AUM {{cta(‘3b9a5d34-e4b1-44d3-a2d6-421ec7a953c3’)}}Source: PRI (https://www.unpri.org/pri), as at 30 April 2019.

{{cta(‘3b9a5d34-e4b1-44d3-a2d6-421ec7a953c3’)}}Source: PRI (https://www.unpri.org/pri), as at 30 April 2019.

While ESG has been adopted by segments of the markets, investors are starting to demand more than a one-dimensional

approach. Flavia Micilotta, executive director at the European Sustainable Investment Forum (Eurosif) highlighted that “Responsible investing has moved on from being principally focused on ethical exclusions of specific companies and sectors to one that also seeks the integration of ESG factors across all asset classes in mainstream fund management.” Yet one of the greatest hurdles within fund management is the absence of consistent ESG standards and data for guidance. Even for more experienced practitioners, it can be a challenge to identify the standards which are most relevant to their investments and investors.

ESG concepts have been embraced especially in certain sectors, but we have found the commodity trade finance (CTF) industry has somewhat lagged in the uptake of responsible investment initiatives. Commodities notoriously have multiple E, S and G risks in their relevant industries, yet it is impossible to “switch off” the asset class given its importance within the global economy. We believe it is the industry’s responsibility to step up and look at wholesale changes in business practices to ensure the long-term sustainability of the sector. Today’s sustainable business practices are currently being driven by the large corporates which dominate the sector. Agricultural producer Cargill, for example, has committed to only trading Roundtable on Sustainable Palm Oil (RSPO)-certified palm oil globally by 2020. Unilever has also committed to 100% sustainable sourcing of all agricultural raw materials by 2020, while the London Metal Exchange is adopting a responsible sourcing policy affecting all traded contracts on the exchange. However, the small and medium-sized enterprises (SMEs) are generally behind the curve.

For CTF asset managers no consistent framework exists; therefore we have developed a bespoke risk assessment with the aim of identifying specific transactional ESG risks. Our toolkit uses data sourced from Maplecroft, a third-party data provider, and provides a quantitative and qualitative assessment of ESG risks specific to the commodity investment and borrower’s operations. We engage with the borrower prior to investment and, based on the ESG risk factors highlighted by our initial data analysis, we create appropriate questions to understand if the borrowers are aware of ESG risks and if / how they intend to mitigate these risks. Based on their responses, we compile an ESG ‘scorecard’ for the proposed transaction. We strive to work with borrowers to reduce their ESG risks wherever possible. However, if the risks are deemed too great and in the long term cannot be mitigated through better working practices, we do not make an investment.

By providing working capital finance to SMEs, typically in emerging markets, we believe it is critical for us to use this position to engage with companies about their ESG credentials. These SMEs face the greatest hurdles in accessing affordable financing while also attaining positive ESG standards within their business. They tend not to have the resources or experience to apply ESG criteria in their day-to-day operations. By providing insights to such risks and mitigants, we aim to influence outlooks and encourage change to their business and their customers, creating more sustainable businesses up and down the supply chain.

In our adoption of ESG practices we are seeking to align mindsets within our industry and the wider asset management sphere. The long-term sustainable returns of companies and the wider global economy are dependent on stable, functioning and well governed social, economic and environmental systems. We want to be at the heart of this wholesale change by bringing responsible investment into the mainstream for commodity trade finance.

“Every company must not only deliver

financial performance, but also show

how it makes a positive contribution

to society.” – Larry Fink

CEO of BlackRock